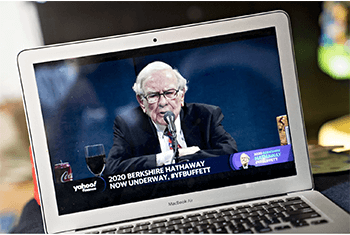

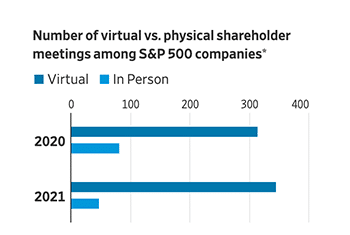

Every spring in the beforetimes, fervent Warren Buffett fans converged in Omaha for Berkshire Hathaway’s annual shareholder meeting. Some 40,000 investors would fly in for the carnival known as “Woodstock for capitalists.” But, like so many large gatherings since March 2020, its past two iterations have been deflatingly virtual.

The video remove didn’t stop Buffett’s event from making headlines in early May: Berkshire’s 90-year-old CEO and its vice chairman, Charlie Munger, spent about three and a half hours fielding questions that shareholders submitted in writing, ahead of or during a webcast from Los Angeles. And with the United States rapidly reopening for post-pandemic life, Buffett ended this year’s meeting by telling investors that “the odds are very, very good that we get to hold this next year in Omaha.”

But most public companies aren’t Berkshire Hathaway—in either party-planning approach or share price. Companies are required by state law to hold yearly gatherings for shareholders to elect their boards of directors; most do so from April through June. The majority of these annual shareholder meetings range from the contentious to the deliberately boring, in what corporate-governance expert Douglas Chia calls “perfunctory exercises.”